Ukraine: Granaries and Mines of the World

The Ukraine war, which began in 2014, has affected several materials supply chains, disrupting the way the industry procures raw materials and goods.

The Ukrainian government's attempts to export agricultural products have been in the news repeatedly in recent months. The war has disrupted farming operations in the region and damaged infrastructure, leading to reduced crop yields and exports of agricultural products such as wheat, barley, and sunflower oil. The blockade of shipping also reduces the possibility of exporting agricultural products, which prevents Ukraine from fulfilling its role as the "granary of the world". Ukrainians exporters accuse Russia of deliberately slowing shipments. Russia is also the world’s top wheat exporter. Together with Ukraine, both account for roughly 29% of the global wheat export market, bringing global hunger back to the world's attention.

However, the war also had an impact on global industry. Ukraine is a major producer of metallic raw materials, such as steel, aluminum and nickel. The market for the export of these products was hit twice. On the one hand, Russian attacks damaged industrial plants, but on the other hand, the infrastructure of this industry was severely damaged: energy supply, transport facilities, trade and labor were all negatively affected by the war, limiting the production and distribution of Ukrainian goods.

The Donbas region of eastern Ukraine, which is a major center of coal and steel production, has been hardest hit. Fighting in the region has disrupted mining operations and damaged infrastructure, leading to a decline in production and exports of coal, iron, and steel. In addition, Ukraine also produces other metals such as aluminum, nickel and titanium.

The exports of steel and aluminium are most important to industry as they are versatile materials that can be used in a wide range of applications, from construction and infrastructure, to manufacturing and transportation. The impact of supply bottlenecks is accordingly great.

Impact on the Steel Market

The two biggest producers of steel and iron in Ukraine are ArcelorMittal Kryvyi Rih and Metinvest. ArcelorMittal Kryvyi Rih is a subsidiary of the global steel giant ArcelorMittal. It is one of the largest steel producers in Ukraine, with an pre-war annual production capacity of around 8 million tonnes of crude steel. The company operates several steel plants in the country, including a large integrated steel mill in Kryvyi Rih. On November 24, due to the massive rocket attack on infrastructure facilities in Ukraine, ArcelorMittal Kryvyi Rih suspended most of the steel making processes. The available electricity were not enough to sustain production of more than 20% of capacity.

Metinvest as a large Ukrainian mining and metallurgical company, it is one of the largest steel and iron producers in Ukraine, with an annual pre-war production capacity of around 14 million tonnes of crude steel. It operates several steel plants in the country and also has iron ore mines in the Donbas region. In an interview for The Economist Yuriy Ryzhenkov, the Group’s CEO said: „Two Mariupol plants have been badly damaged. We don’t know how badly the damage is, but the plants are not operational right now. And definitely after the de-occupation it will take some time to get them operational again.”

Before the outbreak of the war in Ukraine in 2014, the country and both companies were significant producers and exporters of steel, and had a notable market share in the global steel market. According to data from the World Steel Association (WSA), in 2013, Ukraine ranked as the 14th largest steel producer in the world, with a total production of around 24 million tonnes. In terms of exports, Ukraine was also among the top steel exporters in the world, with a market share of around 2.5% in 2013, according to the World Steel Exporters. Ukraine's main export markets were Russia, Italy, Turkey, Egypt and Poland.

Following these developments, steel prices were recorded being as low as $800/ton in early February 2022 before the Russian attacks began. Now, prices have gone as high as $1,900/ton. It's worth noting that the impact on global steel prices by the war in Ukraine is not the only factor, global steel prices are also affected by the demand and supply of steel, investor sentiment, economic growth, and government policies.

Impact on the Aluminium Market

Ukraine is a significant producer of aluminium in Europe. The country has one of the largest aluminium smelters in Europe, Aluminium of Ukraine (AOU) also known as Alchevsk Aluminium Plant, and a number of other companies that produce aluminium products such as Interpipe (steel pipes, including seamless aluminium tubes, profiles, and sheets), UkrAluminium (a major producer of aluminium sheets and coils, profiles and extrusions) and DniproAluminium (aluminium foil, sheets, and plates).

In terms of production, before the war, Ukraine was producing around 230,000 tons of aluminium annually, but the production has decreased since then. In October 2021 and then again in January 2022, aluminum prices exceeded $3,000 per ton. For a short time, prices of over 3,700 USD were reached in March. In the meantime, the price of aluminum has cooled to around 2,600 USD, which is still significantly more expensive than in the past decade, when prices mostly ranged between 1,500 USD and 2,000 USD.

Effect on Industrial SMEs

The disruption of these supply chains has had a significant impact on the Ukrainian economy and has also affected the economies of other countries that rely on these materials and products. In addition to Ukraine, Russia is also a major producer of metals. The export of Russian raw materials, especially to Western countries, has been significantly affected by the sanctions. Russia controls about 10% of global copper reserves, and is a major producer of nickel and platinum. At the same time, SMEs are losing two of their markets.Thus, there are currently many risk factors for the procurement of raw materials and metal components, which are of significant importance for the industry.

Small and medium-sized companies in particular can therefore hardly rely on existing supply chains and are looking for new procurement solutions. It is apparent that the smaller the company and thus the purchasing power, the greater the instabilities in the supply chain become for companies. According to a study by KfW, more than a third of companies with sales of up to 500 MEUR are particularly concerned about the consequences of the Ukraine war and need to reconsider their procurement strategy.

From linear supply chains to distributed networks

To overcome the size disadvantage and the lack of crisis resistance of linear and direct supplier relationships, SMEs are increasingly relying on intelligent procurement solutions with resilient supplier networks. Digital production platforms manage complex purchasing processes and increase purchasing power by bundling projects. This has a positive effect on delivery reliability, purchasing conditions and procurement costs for SMEs.

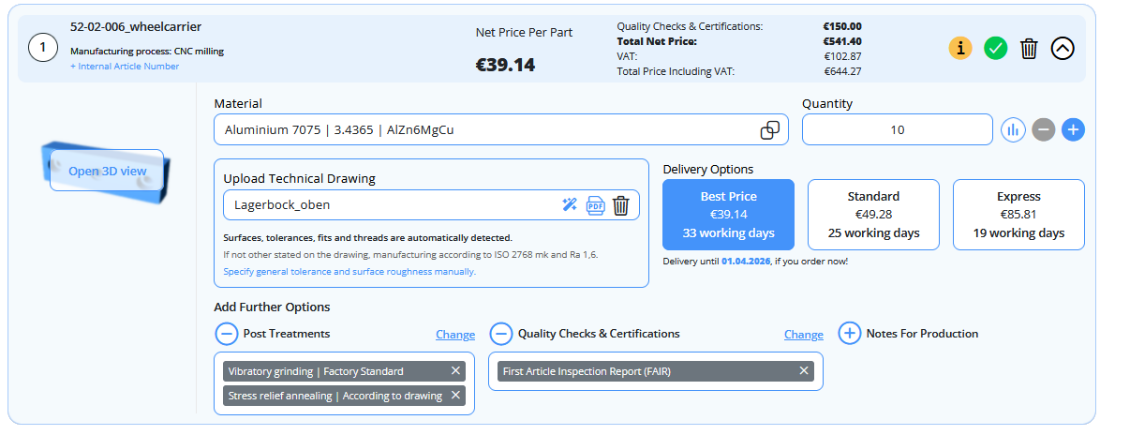

InstaWerk is a production platform dedicated to the procurement of CNC turned and milled parts. Through the supplier network, customers can utilize the capacity of 3,000 machines. Convenient online ordering options and direct support contacts for demanding projects are helping SMEs to stay competetive in global markets beside arising turbulences.

The crises of recent years are causing a massive shift in companies' procurement processes from linear dependencies to resilient supply networks. By specializing in CNC manufacturing at InstaWerk, we can leverage our distributed manufacturing advantage for you with a high degree of specialization.